In many cases, you provide clothing for your employees. Think overalls, but also hats, mackintoshes or work trousers.

When this clothing becomes the property of the employee, it actually counts as wages in kind. Therefore, the employee would have to pay payroll tax on this as well. After all, it could be a cheap way to obtain casual clothing.

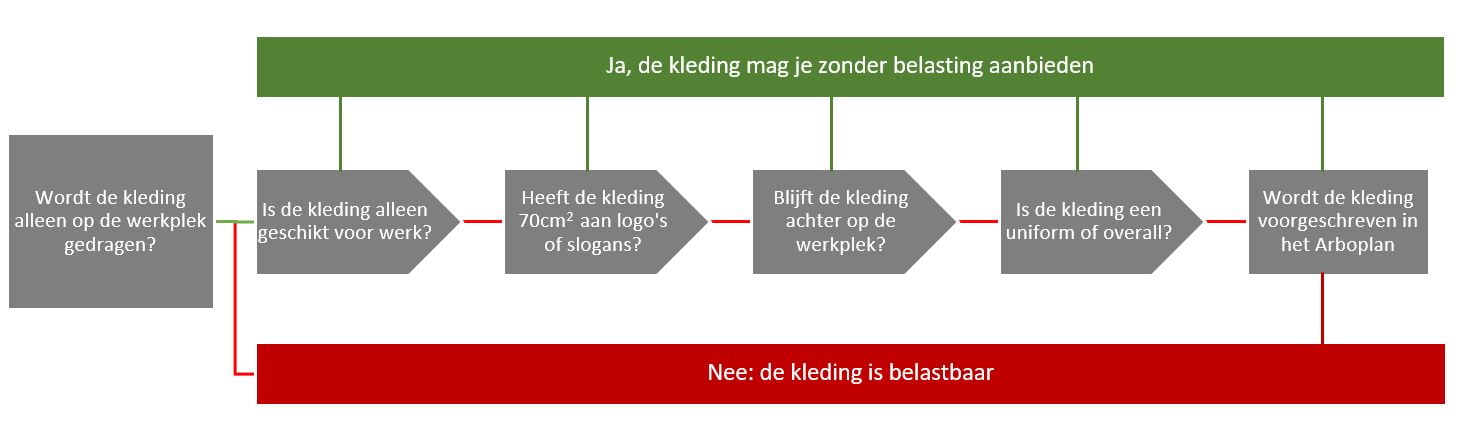

However, there are exceptions that allow workwear to remain untaxed:

- Clothing suitable only for the job: Consider specific work or safety clothing, such as overalls, uniforms, lab clothing and shirts with RWS striping.

- Clothing required due to occupational safety: the clothing is prescribed by the Working Conditions Act and matches the safety measures in your occupational health and safety plan. The clothing is worn mainly while working.

- Clothing that has clear image features: The workwear is printed or embroidered with logos or slogans of the employer. These cover at least 70cm2 per garment.

See a choice list below. Therefore, if clothing meets any of these conditions, the employer may provide it untaxed. After all, there is little chance that he will wear these clothes in his spare time.

Unnecessary printing

We see many companies printing their clothes. However, this is not to do with tax, but with recognition. This is understandable: your employees need to look presentable and recognisable. However, this can already be done by choosing recognisable colour schemes in the house style.

In principle, safety clothing does not need to be printed. Indeed, if the printing process is done carelessly, it can invalidate safety standards! So get advice from a PPE adviser.

Mandatory printing

Are you required to print clothes though? Then make sure the logo is clearly visible. Usually the chest, back and/or shoulder. Also pay attention to the dimensions: at least 70cm2 of the clothing fabric must be printed. This is perfectly feasible: a 5x14cm logo or 2 5x7cm logos per garment is sufficient. In practice, we often see a larger total area printed.

With a rectangular logo, it is easy to measure. But with rounded or freestanding images, it is trickier. In that case, you measure in a rectangle that covers the entire logo from corner to corner.

Reimbursement of cleaning

Cleaning workwear is essential. Personal safety can be compromised when high-vis striping is smeared, or when flame-retardant clothing is covered in oil stains. Sometimes workwear is cleaned in industrial laundries. But many work clothes are also cleaned at home or at a laundrette. If the employee charges for this, he does not have to pay tax on these either, provided they meet the conditions mentioned.

Summary:

Safety clothing is not taxable. Other workwear is, unless it is printed with the employer's logos for 70cm2. Reimbursement of clothing need not be taxable.

Do you want to put employees in recognisable jackets? Make sure this is done carefully: it must comply with safety rules as well as tax regulations. Finally, there are several ways to create recognisability.

So be sure to get advice when putting together workwear! Read more about the look of your corporate clothing here.